Drone Insurance: Covering the Future of African Agriculture

Africa is grappling with deepening socioeconomic vulnerabilities driven by climate change. Erratic rainfall, prolonged droughts, floods and rising temperatures are increasingly threatening food security, biodiversity, public health and economic development. The continent contributes just 2–3 per cent of global greenhouse gas emissions. But, according to the United Nations Environment Program me (UNEP), it remains the most climate-vulnerable region in the world.

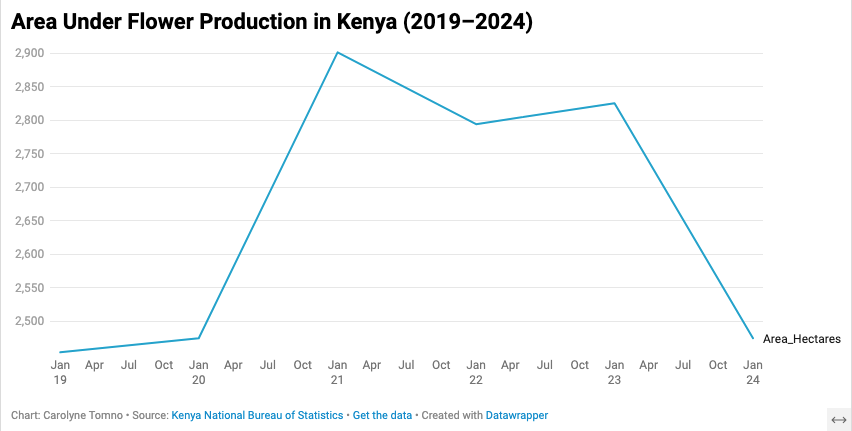

In Kenya, climate stress is being felt acutely in agriculture .Floriculture, one of the country’s most valuable export industries has been hard hit. The flower sector contributes an estimated 1.5 to 2.5 per cent of GDP, directly employs between 100,000 and 200,000 workers, and supports over two million livelihoods. As one of the world’s leading exporters of cut flowers, especially roses, Kenya’s industry has long relied on favorable equatorial conditions. Today, those conditions are increasingly unpredictable.

To maintain its global competitiveness amid climate pressure and demanding eco-conscious markets, Kenya’s floriculture sector has been forced to pursue excellence across sustainability, worker welfare and environmental management. Technology , including artificial intelligence (AI), machine learning, and big data, is changing this. The approach blends drone technology and AI with rich horticultural expertise to redefine sustainable flower production. This, in turn, creates a more predictable, viable, efficient, and resilient industry.

precision agriculture has become central to that effort.

At dawn on a commercial flower farm in Limuru, on the outskirts of Nairobi, a drone completes its flight between neat rows of roses. In minutes, it scans soil moisture, detects pest stress and maps crop health. The tasks once took days of manual labor. The data allows farm managers to act early, conserving water, reducing chemical use and protecting yields before losses occur.

According to Chris Kulei, chairman of the Kenya Flower Council, competition in export markets is driving farms to adopt higher sustainability standards and diversify markets. He notes that the industry has rebounded strongly after the COVID -19 pandemic, with renewed investor interest and a growing focus on technology, value addition and precision agriculture. More than 80 per cent of flower farms now hold social and environmental certifications, a signal of the sector’s shift toward responsible production.

Kulei who is also the managing Director of Sian Roses is excited about the Fair trade certification of his farms. Speaking at Masai Roses one of the four farms under the Sian Roses Kulei explained that Fairtrade certification has given Kenyan flower producers a competitive advantage. This is particularly in European markets, and he is encouraging more members to meet these standards of the high stakes trade

“Smart agriculture is about more than yield,” Kulei says. “It’s about understanding how efficiently we use water, what impact we have on the local environment, and ensuring responsibility in inputs.” He adds that high standards are essential to protect Kenya’s reputation as a sustainable producer.

Across the floriculture sector, unmanned aerial vehicles commonly known as drones are now widely used to meet strict international quality and environmental requirements. Commercial farms report reduced labor costs, faster field operations and improved yields. Spraying drones, in particular, have helped cut chemical wastage and reduce worker exposure to hazardous pesticides enhancing occupational safety.

But as digital tools and artificial intelligence spread across African agriculture, they introduce new categories of risk. Equipment failure, mid-air collisions, property damage and third-party injury, ,all carry potentially high financial consequences. Regulation alone cannot eliminate these risks.” Musa Abdi, a trained drone operator, says risk is never far from his mind. “Every flight raises concerns about privacy and cybersecurity,” he notes,

In Kenya, the Kenya Civil Aviation Authority (KCAA) requires licensed drone operators to carry third-party liability insurance, recognizing that financial accountability is essential when technology fails. When insurance works, innovation continues. When it does not, a single incident can ground operations, trigger lawsuits or shift costs onto communities and public infrastructure.

Drone insurance, once a niche product is now becoming essential. It is a specialized form of aviation insurance designed to cover unmanned aerial vehicles used for commercial purposes, including mapping, spraying and crop monitoring. Agribusinesses, start-ups and large commercial farms increasingly rely on these covers to protect both assets and operations.

Most drone insurance policies combine two core components: hull and equipment cover, which protects against loss or damage to the drone itself, and third-party liability cover, which addresses injury or property damage caused to others. Together, they protect operators and the public — a critical consideration as drones move beyond controlled environments into open agricultural landscapes.

According to Moses Sampeke, a digital marketer at Nairobi-based Step by Step Insurance Agency, demand for drone insurance has surged alongside the growth of agricultural drone use. “The drone industry has grown by more than 30 per cent in the past year, driven largely by agriculture,” he says. Farms are deploying drones for crop planning, irrigation management, soil and pest analysis, precision spraying and pest control, embedding the technology into daily farm operations.

Contrary to common perception, drone insurance is not limited to large commercial farms. Sampeke notes that smallholder farmers can access drone services through cooperatives and group insurance arrangements, lowering costs and expanding access. Premiums vary depending on drone size, usage and risk profile. Insurers, emphasize the importance of proper pilot training. Certified operators experience fewer accidents and lower long-term costs.

To support uptake of insurance in general, the Insurance Regulatory Authority (IRA) has intensified public awareness campaigns across Kenya, targeting youth, start-ups and technology-driven enterprises. Improved claims settlement processes, greater consumer empowerment, and stronger complaints-handling mechanisms put in place by the Authority have boosted confidence in the insurance sector.In the first half of 2025, insurance claims in Kenya rose by Sh27.5 billion compared to the same period in 2024this is a boost at a time when technological risks continue to multiply.

Innovation is also transforming how insurance is delivered.At the BimaLab Africa InsurTech Summit 2025 in Nairobi. Ted Pantone, CEO and co-founder of Turaco, said the company launched in 2019 with the goal of insuring one billion Africans, has expanded to Uganda, Nigeria and Ghana, now serving over one million customers and processing more than 20,000 claims

A new Regulatory Sandbox Eligibility Assessment Toolkit was also launched at the BimaLab Insurtech Accelerator Summit held in Nairobi in 2025.

Commenting on the launch, IRA CEO and Commissioner Godfrey Kiptum said the initiative strengthens regulatory readiness for innovation, helping build a more resilient and inclusive insurance ecosystem for the next decade, while providing a valuable reference for regulators across Africa.

Why reinsurance matters

As drone use scales across African agriculture, risk no longer sits with individual farms or operators. Exposure accumulates across regions, seasons and airspace from weather-related losses and equipment failure to third-party liability and supply-chain disruption. This aggregation of risk is where reinsurance becomes critical..Rwanda’s tightly regulated drone ecosystem , particularly in medical delivery and is often cited as a model, with clear corridors and centralized oversight reducing uncertainty and making risk easier to price. Elsewhere, especially in parts of West Africa, drone adoption in agriculture, mining and environmental monitoring is advancing fast

In a continent defined by climate volatility and rapid innovation, insurance and reinsurance , will determine whether progress takes flight or remains grounded.