Africa Moves to Control Its Medicines Market

By Chemtai Kirui

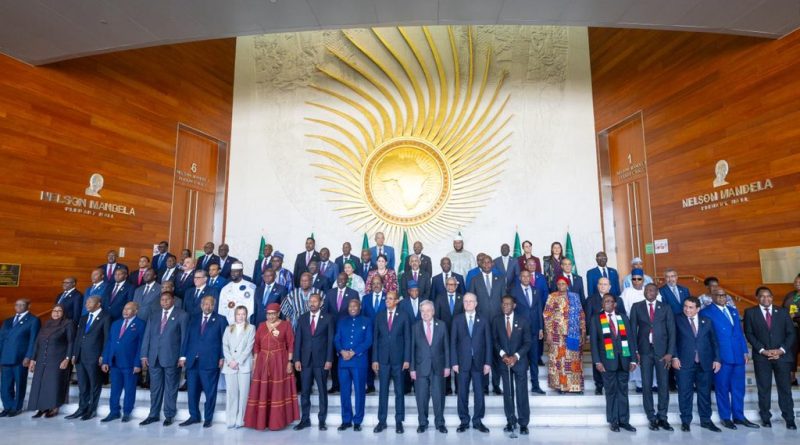

Addis Ababa, February 2026 — As African heads of state gathered in Addis Ababa for the 39th Ordinary Session of the Assembly of the African Union, public discussions focused on familiar pressures: insecurity in the Sahel, instability in eastern Democratic Republic of Congo, the war in Sudan, and growing water scarcity.

But at a closed-door presidential breakfast devoted to health policy, another question dominated the room: who controls Africa’s medicines market?

Behind the communiqués and summit declarations, leaders returned repeatedly to a structural weakness that has long shadowed the continent’s pharmaceutical ambitions — regulatory fragmentation.

Africa’s pharmaceutical market is estimated at roughly $50 billion annually. Yet it operates across 55 separate regulatory jurisdictions.

For manufacturers, each jurisdiction requires separate approvals, inspections and compliance processes. For investors, that patchwork translates into cost, delay and uncertainty.

At this year’s summit, the tone shifted from aspiration to implementation. The African Medicines Agency (AMA), once framed as a technical harmonization effort, was presented as a central instrument of economic sovereignty.

The debate was no longer simply about patient safety. It was about market power.

The African Medicines Agency was established by treaty in February 2019 and entered into force in November 2021. Headquartered in Kigali, Rwanda, the agency is designed to coordinate and harmonize national regulatory systems across the continent — not replace them.

Its origins lie in the African Medicines Regulatory Harmonization (AMRH) initiative launched in 2009 under the African Union Development Agency (AUDA-NEPAD). That program laid the technical groundwork for aligning standards and inspection procedures.

The AMA represents the political evolution of that effort — from voluntary coordination to a treaty-based institution.

The agency operates through a Conference of State Parties, a Governing Board, a Secretariat based in Kigali, and specialized Technical Committees. These committees are tasked with setting continental standards in areas such as Good Manufacturing Practice (GMP) inspections and the evaluation of complex products including biosimilars and vaccines.

By early 2026, the AMA had entered what officials describe as its “Expansion Phase” (2026–2030), following a foundational period (2024–2025) during which 43 core staff were recruited and governance structures established.

Yet six years after its adoption, the treaty remains incompletely ratified.

As of February 2026, 31 of the African Union’s 55 member states have ratified the agreement. Twenty-four have not.

That gap leaves the agency operating in what officials privately describe as a “patchwork” environment — one where regulatory standards vary and cross-border vulnerabilities persist.

Countries that have ratified the treaty include Algeria, Benin, Burkina Faso, Cameroon, Chad, Egypt, Ethiopia, Gabon, Ghana, Guinea, Lesotho, Mali, Mauritius, Namibia, Niger, Rwanda, Seychelles, Sierra Leone, Tunisia, Uganda, Zambia, Zimbabwe, Senegal, Cape Verde, Democratic Republic of Congo, Kenya, Tanzania and Côte d’Ivoire.

Major economies such as South Africa have not yet fully ratified the treaty, although their regulators participate in technical work-sharing arrangements.

African officials increasingly frame fragmentation not merely as administrative inefficiency, but as a structural vulnerability. Without harmonized standards, medicines rejected in one jurisdiction can enter another with weaker oversight. From there, they may circulate across regional trade corridors.

The result, regulators argue, is exposure to substandard or falsified products and a deterrent effect on serious pharmaceutical investment.

At the summit, leaders urged the remaining states to ratify the treaty without delay. Seychelles Vice President Sebastien Pillay pledged $200,000 in support of the agency and publicly called on others to match financial commitment with political endorsement.

The message was clear: regulatory sovereignty requires both signatures and funding.

The AMA operates under a “reliance model,” whereby assessments conducted by more mature regulators can be leveraged by others to accelerate approvals, reducing duplication and conserving scarce technical capacity.

The World Health Organization’s Global Benchmarking Tool (GBT) remains the primary measure of regulatory strength, ranking authorities from Maturity Level 1 to 4.

Only a handful of African regulators have reached Maturity Level 3 — a designation indicating stable and well-functioning oversight systems — including those in Egypt, Ghana, Nigeria and South Africa.

Kenya’s Pharmacy and Poisons Board is currently pursuing that benchmark.

A significant milestone during the 2026 summit was the signing of a Memorandum of Understanding among leading African National Medicines Regulatory Authorities (NMRAs). The agreement commits signatories to shared evaluation reports and joint GMP and Good Clinical Practice (GCP) inspections.

For industry, this is intended to reduce repetitive submissions and streamline approvals across borders.

The regulatory push intersects with a broader industrial target.

The African Union has set a goal of producing 60 percent of vaccines and essential medicines locally by 2040. Today, the continent imports the vast majority of its pharmaceutical products.

Manufacturing alone, however, cannot resolve fragmentation.

A Kenyan-produced vaccine must still navigate multiple national approval systems before it can be marketed across the continent. Without a unified regulatory framework, scale remains elusive.

That is where the AMA is intended to intervene — by creating what some leaders describe as a “single window” for pharmaceutical approvals across a market of 1.4 billion people, reinforcing the ambitions of the African Continental Free Trade Area.

Regulation is only one side of the equation.

To address demand-side constraints, the Africa Centers for Disease Control and Prevention (Africa CDC) has launched the African Pooled Procurement Mechanism (APPM).

The initiative aggregates purchasing demand across countries, offering local manufacturers larger and more predictable markets.

A related APPM Capital Fund has been established to mobilize financing for facility upgrades and technology transfer, with the aim of converting political commitments into bankable projects.

Industry groups, including the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), argue that regulatory harmonization must be accompanied by what they describe as a “conducive policy environment” — predictable legal frameworks, reliable energy, manageable input costs and coherent trade policy.

Investors warn that without such conditions, production targets may remain aspirational.

Kenya has positioned itself as a leading advocate of regulatory consolidation.

President William Ruto, designated the African Union’s champion for local manufacturing, used the Addis summit to press for accelerated ratification of the AMA treaty.

Nairobi is advancing its National Health Products and Technologies (HPT) Local Manufacturing Strategy 2026–2030 and developing biotechnology infrastructure linked to Konza Technopolis, including a planned Biopharma Life Sciences Park.

For Kenya, regulatory harmonization carries both continental and domestic implications. Local manufacturers cannot scale regionally if regulatory barriers persist.

The next policy test will take place in Nairobi.

The African Union has endorsed an Extraordinary Summit on African Health Products Manufacturing, to be hosted and chaired by Kenya in 2026. The meeting is expected to focus on procurement reforms, pooled purchasing mechanisms and binding commitments aimed at translating declarations into enforceable market rules.

Nairobi will also host a World Health Summit Regional Meeting, where policymakers and industry leaders are expected to debate how Africa can transition from aid-dependent health systems toward industrial self-reliance.

The shift from technical harmonization under AMRH to a treaty-based agency under the AMA signals a deeper recalibration. Regulation is no longer treated solely as a public health safeguard. It is being positioned as a strategic economic instrument.

The path to that 2040 manufacturing target remains uneven. Technical capacity varies widely. Ratification is incomplete. Financing is still developing.

But the combined momentum of the AMA’s expansion phase, the pooled procurement mechanism and new regulatory cooperation agreements suggests that the architecture of a continental pharmaceutical market is taking shape.

The debate unfolding in Addis Ababa — and soon in Nairobi — is ultimately about whether African states can consolidate authority over their own medicines market.

In that contest, regulatory standards have become a proxy for sovereignty.