SGR loan converted from USD to yuan to cut interest costs

By Chemtai Kirui || Kass Digital

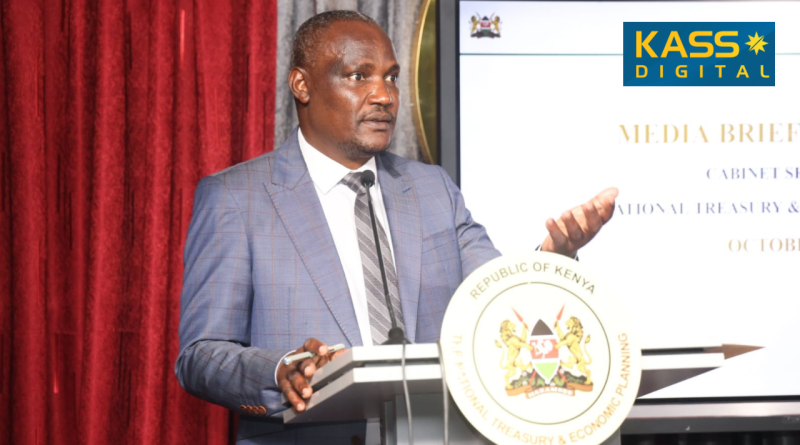

The government has converted the $5 billion Standard Gauge Railway (SGR) loan from U.S. dollars to Chinese yuan, a move aimed at lowering interest payments and reducing exposure to foreign exchange risk, the Cabinet Secretary for the National Treasury and Economic Planning, John Mbadi, has announced.

The SGR, the country’s largest infrastructure project since independence, was financed mainly through Chinese loans from the Exim Bank of China.

The currency swap is expected to save about $215 million annually in interest payments, Mbadi said.

“It kicks off immediately,” he told reporters during a press briefing, adding that the conversion will expand the country’s fiscal breathing room.

Mbadi said total public debt stood at KSh 11.81 trillion (67.8% of GDP) as of June 2025, with KSh 5.48 trillion owed externally. He added that the currency switch is part of a broader liability management plan aimed at reducing exposure to foreign exchange and interest rate fluctuations.

“We are refinancing high-cost obligations, extending maturities, and pursuing concessional financing to strengthen debt sustainability,” Mbadi said.

Previously, the loan was serviced in U.S. dollars, making the country vulnerable to fluctuations in dollar interest rates and foreign exchange valuations. By shifting to yuan payments, officials say the country will reduce that vulnerability. However, challenges remain.

The conversion follows earlier negotiations between Nairobi and Beijing to swap dollar‐denominated debt into yuan. Treasury officials say regulatory reviews are ongoing, while economic analysts note that such a shift typically requires creditor consent and legal adjustments to ensure the new repayment terms comply with both countries’ financial frameworks.

Economists say dollar-based loans, particularly those tied to global markets, usually carry higher interest rates than comparable yuan loans from Chinese state lenders. Converting the liability therefore lowers interest costs, while servicing in yuan reduces the need to convert shilling reserves into dollars, easing pressure on foreign exchange holdings.

Geopolitical and financial significance

Switching debt repayment from the U.S. dollar to the yuan carries both financial and diplomatic implications. The move deepens the country’s economic ties with China — its largest bilateral lender — and fits into Beijing’s broader effort to expand the yuan’s global use. Analysts say it also reflects how some developing countries are rethinking their reliance on the dollar, which has long dominated international trade and debt markets.

Financial experts, however, caution that the shift will not eliminate risk, noting that fluctuations in the yuan or changes in China’s financial policy could affect repayment terms. They say creditor consent and transparent implementation are central to ensuring the conversion achieves its intended results.